Mortgage Rate Forecast: Don’t Expect a Big Drop Anytime Soon

Published July 2025

If you’re waiting for a big drop in mortgage rates before jumping into the housing market, you might be waiting longer than expected.

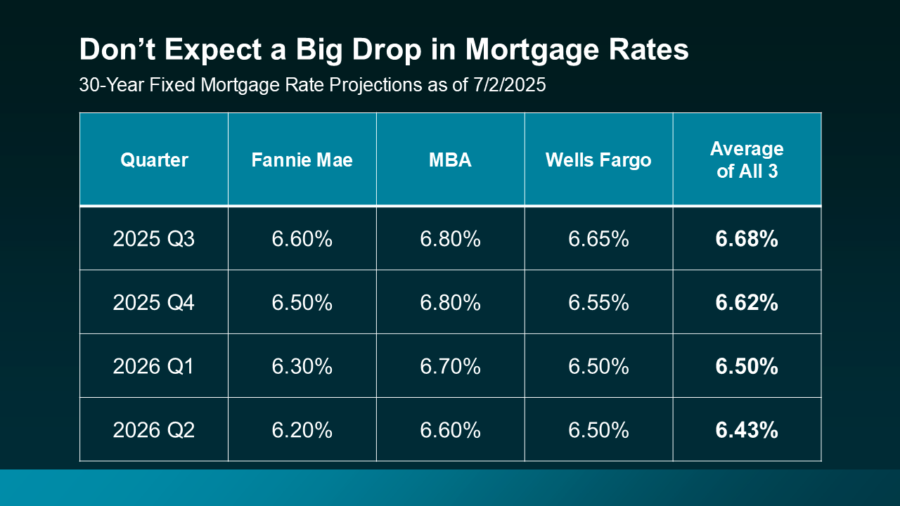

According to projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo, 30-year fixed mortgage rates are expected to remain in the mid-to-upper 6% range well into 2026. Here’s what the average forecast looks like across these three major institutions:

- Q3 2025: 6.68%

- Q4 2025: 6.62%

- Q1 2026: 6.50%

- Q2 2026: 6.43%

While there is a slight downward trend projected through mid-2026, the key takeaway is this: rates are not expected to fall dramatically anytime soon.

What This Means for Buyers

If you’re considering buying a home and waiting for rates to drop into the 5s—or even the 4s—you may be sitting on the sidelines for quite a while. With home prices holding steady or climbing in many areas, waiting could actually cost more in the long run.

Instead, buyers may want to focus on negotiation power, inventory levels, and homeownership goals, rather than trying to time the market perfectly.

The Bottom Line

Experts agree: mortgage rates will likely stay in the 6.4%–6.8% range over the next 6 to 12 months. If you’re financially ready to buy, now could still be a smart time to act—especially if you find the right home and secure favorable terms.

Have questions or want to talk through your options? I’m here to help with real data and zero pressure.