Baby Boom + Pandemic + Very Low Interest Rates = Not Enough Homes to Meet the Demand

We have been hearing for months about how low housing inventory is. But why?

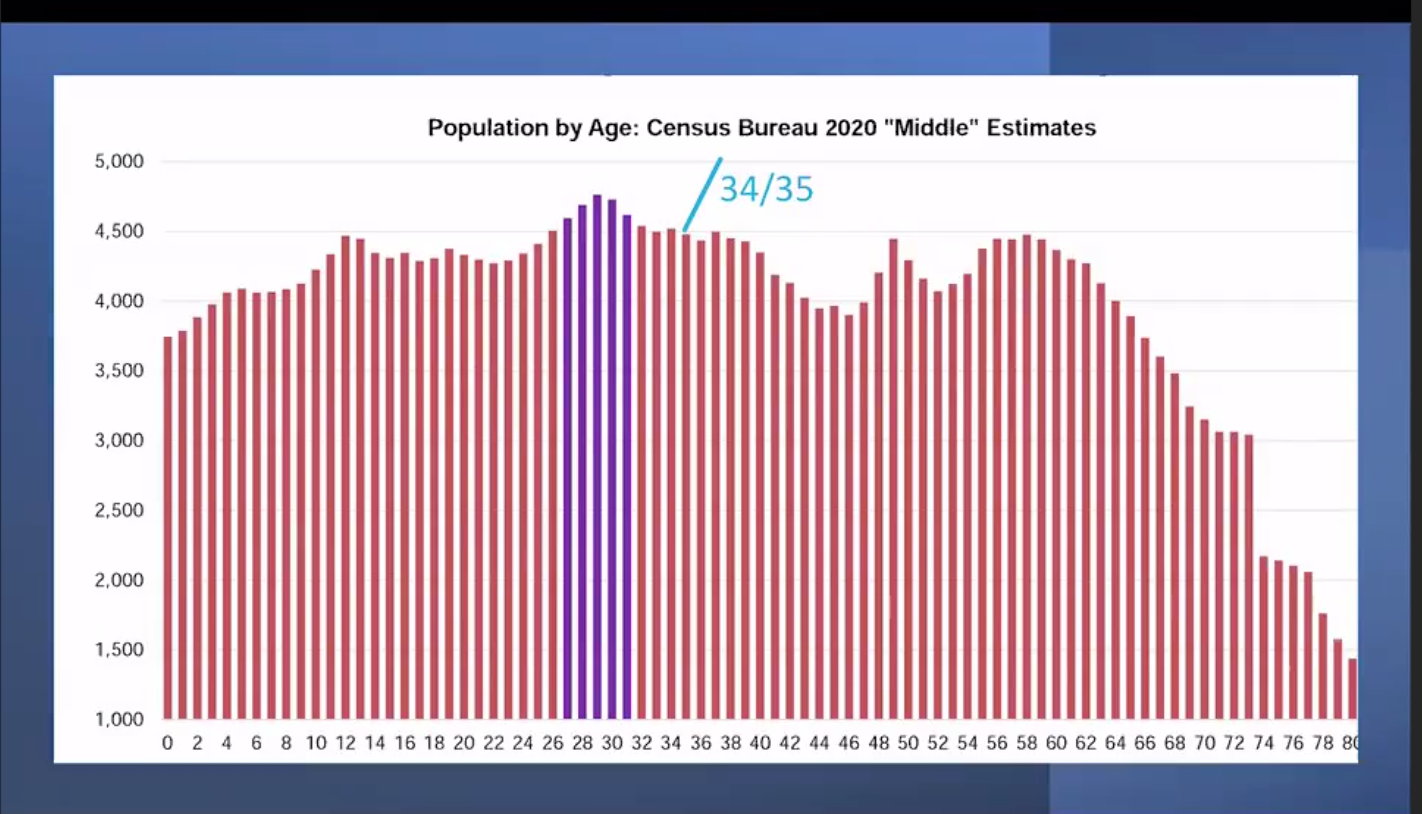

Babyboom

According to the latest census, about 30 years ago there was a significant baby boom. And now, there are lot of buyers looking to buy a home. This is a classic example of supply vs. demand.

Pandemic

Now, add a pandemic to the mix. After being quarantined at home for a few weeks/months, many decided that they no longer wanted to be in small condos or apartments in urban areas. Moving out to the suburbs or remote areas started to become popular because they wanted/needed more space.

Low Interest Rates

Finally, having historically low mortgage interest rates meant that buyers could afford to buy their first home or a home in a higher price range. And, current home owners that were thinking about selling, could now refinance at very low rates, which reduced their monthly payment and most likely put their moving plans on hold. Thus, contributing to the low inventory cycle.

The economists predict that we will remain in this cycle for a few more years, and eventually interest rates will increase. So even though it seems that prices are increasing, the homes will only become more expensive the longer you wait to purchase. Please contact me anytime you have questions on how this current market influences your future plans.